Mobile banking has become essential for managing finances conveniently and securely in today’s fast-paced world. With upi payment and just a few taps on your smartphone, you can check your account balance, transfer funds, pay bills, and much more. If you’re new to mobile banking, feeling overwhelmed is natural. However, getting started is easier than you think. This article will walk you through simple steps to begin your mobile banking journey.

Step 1: Choose a Reputable Bank or Financial Institution

The first step is to select a trustworthy upi bank or financial institution that offers mobile banking services. Look for a well-established institution with a solid security and customer service reputation. Consider factors such as user reviews, app ratings, and the mobile banking app’s range of features.

Step 2: Download the Mobile Banking App

Once you’ve chosen your bank, visit your smartphone’s app store (such as the Apple App Store or Google Play Store) and search for your chosen institution’s official mobile banking app. Download and install the app on your device. Ensure you download the legitimate app the bank publishes to avoid fraudulent activity.

Step 3: Register Your Account

After installing the mobile banking app, open it and follow the on-screen instructions to register your account on bank upi. Typically, you’ll need to provide your account details, including your account number, username, and password. Ensure you choose a strong, unique password that is not easily guessable. It’s essential to protect your login credentials to maintain the security of your account.

Step 4: Verify Your Identity

To ensure the security of your account, the mobile banking app may require you to verify your identity. This verification process usually involves confirming personal information, such as your date of birth and social security number, or answering security questions. This step adds an extra layer of protection against unauthorized access to your account.

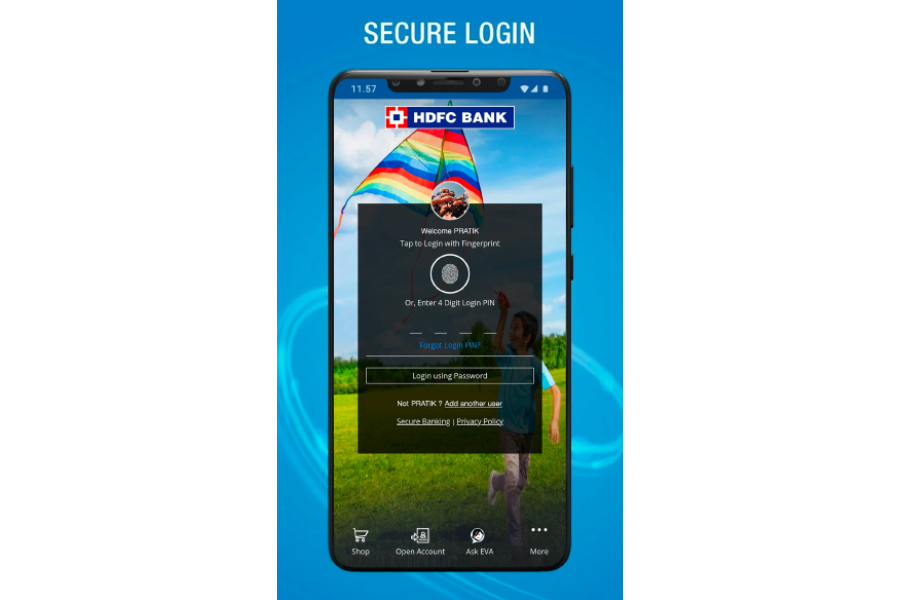

Step 5: Set Up Security Features

Mobile banking apps offer various security features to protect your financial information. Take advantage of these features to enhance the safety of your account. Enable options such as fingerprint or facial recognition login, two-factor authentication, and alerts for suspicious activities. Regularly update your app to benefit from the bank’s latest security enhancements.

Step 6: Familiarize Yourself with the App

Once you’ve completed the initial setup, take some time to explore and familiarize yourself with the mobile banking app. Navigate through the different sections to understand its features and capabilities fully before any upi transfer. Most apps allow you to view account balances, transaction history, make transfers, pay bills, and deposit checks. Read any instructions or tutorials the bank provides to maximize your app’s functionality.

Step 7: Opt for Additional Services

Mobile banking goes beyond basic account management. Many apps offer additional services like budgeting tools, expense tracking, NEFT money transfer, investment management, and loan applications. Take advantage of these features to streamline your financial activities and gain better control over your money.

Step 8: Stay Informed and Educated

As mobile banking technology evolves, it’s crucial to stay informed about new updates, features, and security practices. Keep an eye on the bank’s website, official communications, and the app for any announcements or notifications. Educate yourself on best practices for mobile banking security to protect yourself from potential threats.

In conclusion, mobile banking has revolutionized the way we manage our finances. You can confidently embark on your mobile banking journey by following these simple steps. Remember to choose a reputable bank, download the official app, register your account securely, and take advantage of the app’s features and security options. Stay informed and make the most of the convenience and accessibility that mobile banking offers.