If you are a business owner in Colorado that sells medical or recreational marijuana, perhaps you should think about getting insurance for your business. Other businesses have insurance – this should be no different.

Business insurance

Business insurance is a way of a business protecting themselves from financial loss. It is a vital part of risk management and is a protection against any uncertain losses. Companies that sale insurance is known as:

- Insurer

- An insurance company or carrier

- Underwriter

This is a means of a business protecting themselves from any number of things that can cause business loss.

Legalized marijuana

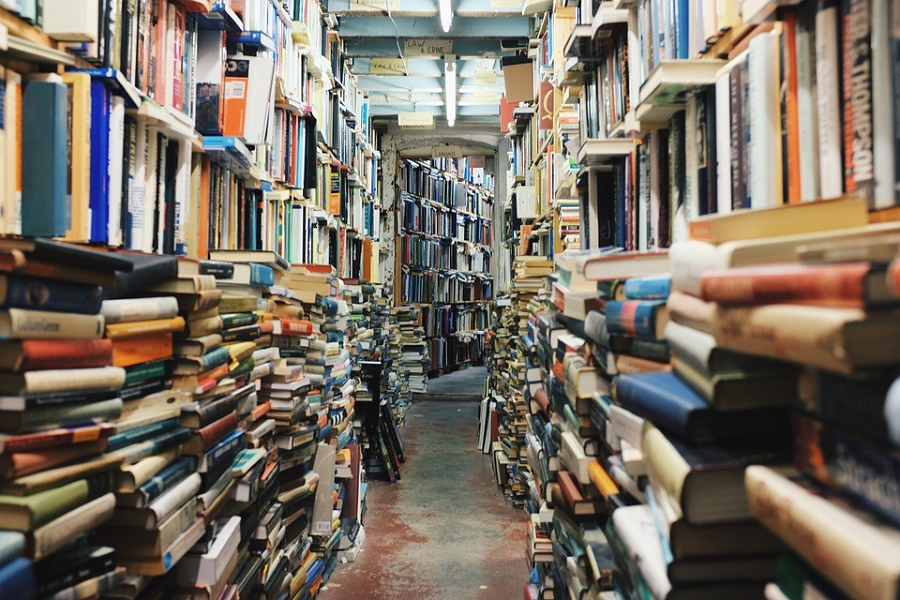

Since Colorado legalized the sale of marijuana there are hundreds of new businesses that sell both medical and recreational marijuana. The latest news is that these businesses need to have business insurance to protect themselves no matter what size the business is. And medical marijuana business insurance in Colorado is available. These businesses face challenges just like other businesses and insurance could be the best defense they have for any risks faced on a daily basis.

Protection

There are many risks that can tank business in this field but having business insurance can help. Here are some examples of types of insurance.

- Crop failures -both federally subsidized and privately offered insurance.

- General, professional and products liability coverage.

- Workers compensation.

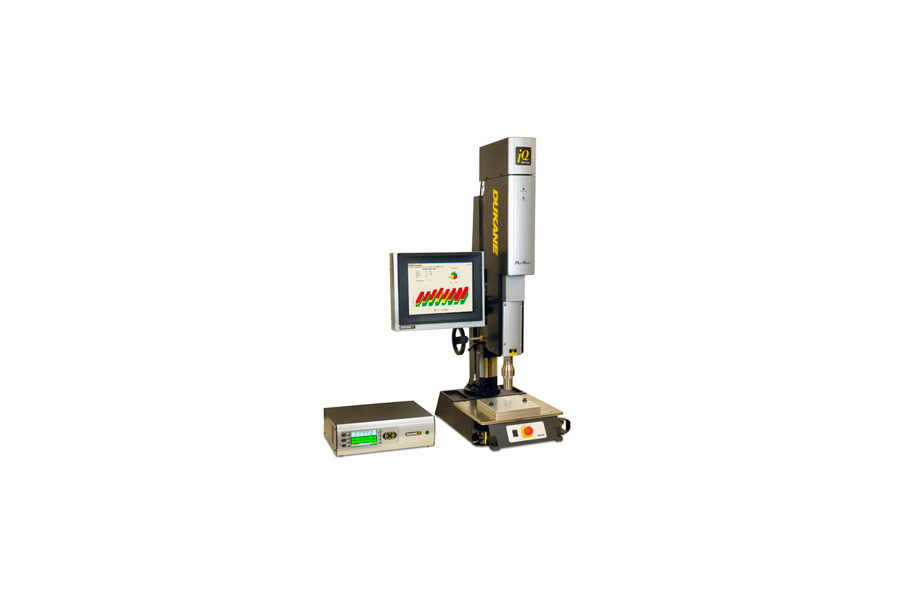

- Insurance on greenhouses, buildings, and equipment.

- Transportation/cargo.

- Landlord/lessor risk only policies.

- Life and disability protection for key-person or group.

- Directors/Officers liability.

There are situations that can close businesses when having the proper insurance can save them.

Risk management

So even if you have a small business that sells legalized marijuana in the state of Colorado it is vital that you investigate business insurance. If you speak with an insurance agent, he can give you advice on what type of policy is best for your business.